accounting services tax deductible

Job in New York City - Richmond County - NY New York - USA 10170. An accrued expense is deductible when it is fixed in place.

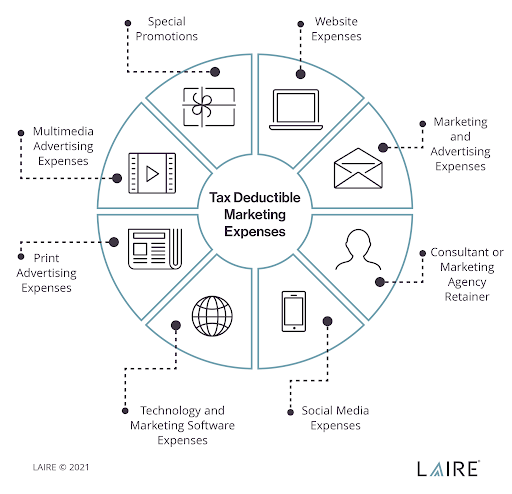

Write Off Your Marketing Expenses And Save Money On Your Taxes

You generally cant deduct the fees that you would normally charge for your services as pro bono services.

. Our global network of tax professionals helps you achieve better control over tax accounting matters through customized tax services to meet the needs of your business. It is the process of calculating the depreciation charge or simply expense that can be allocated in the accounting period. Professional services like Xendoo are 100 tax deductible.

This means that if. To be deductible a business expense must be. 5 Accounting Services That Are Tax Deductible.

When you claim federal tax credits and deductions on your tax return you can change the amount of tax you owe. Accounting expenses auditing expenses and bookkeeping expenses are all deductible business expenses. On 31 March 2003 the Disputant accrued 228500 as being estimate of 2003.

Accountants offer a wide range of services to businesses with most if not all. Financial or accounting programs that you purchase subscriptions to in order to track your finances throughout the year may also be tax deductible but only during the year in. Financial Services Tax Senior.

If youre an employee and you receive a W-2 in order to prepare your taxes the short answer is that you are no longer able to deduct your. This means that there are no conditions or contingencies that exist that bring into question that a true liability exists. Only the self-employed can claim a deduction for tax preparation fees in tax years 2018 through 2025 if Congress does not renew legislation from the TCJA.

But you might be able to take. The deduction is figured on the size of the home office as a percentage of the total house or residence. Here is a more detailed list of.

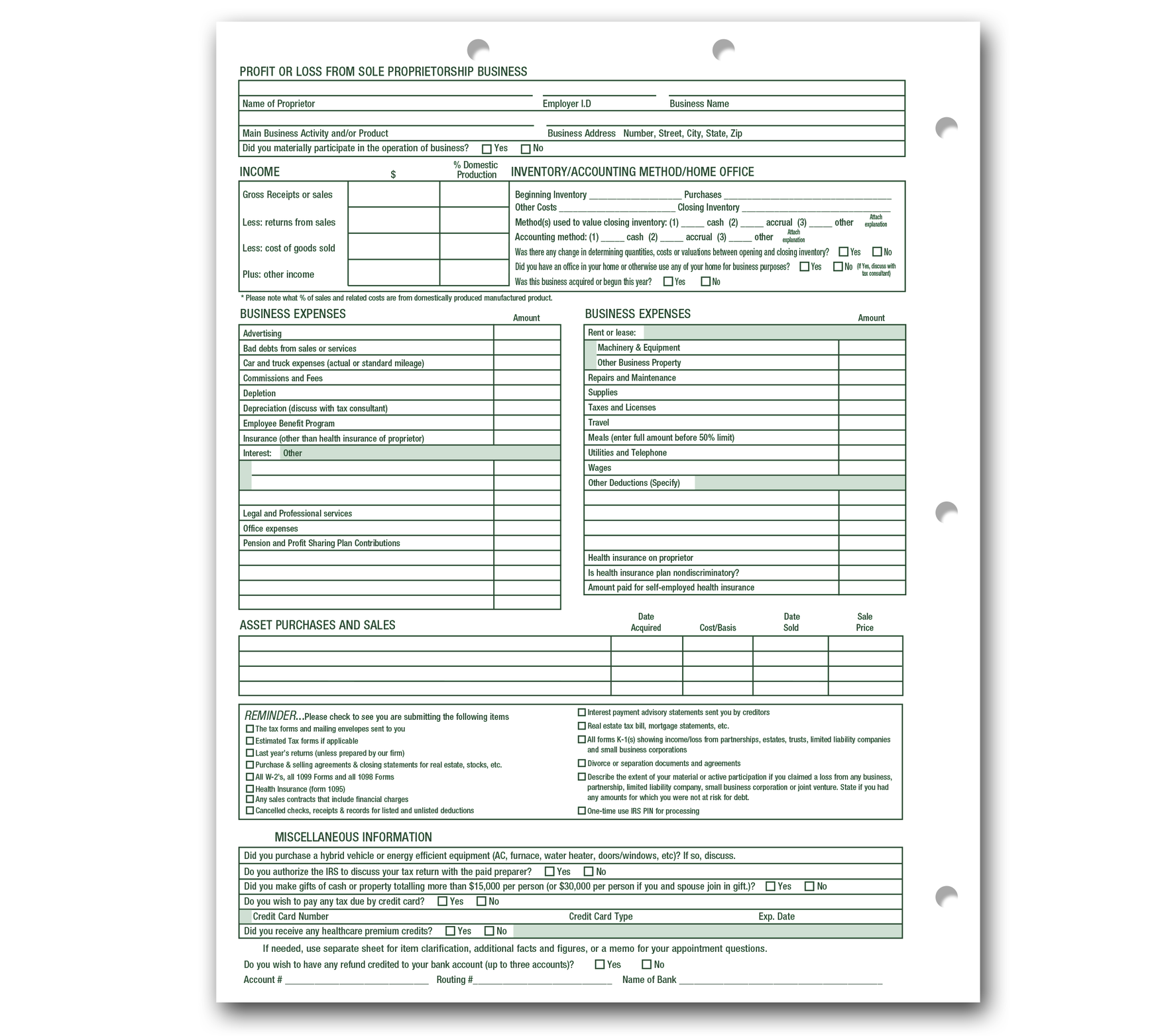

Ad Manage All Your Business Expenses In One Place With QuickBooks. Are accounting services tax deductible. Respond to IRS and state tax notices.

Explore The 1 Accounting Software For Small Businesses. 5 Accounting Services That Are Tax Deductible. Deductions can reduce the amount of your.

In addition there is a. Startup legal fees could be for helping you review contracts hire executives or travel to negotiate purchase of a business. Tax depreciation charge is a tax-deductible expense.

Deducting Tax Preparation Fees on Personal Taxes. 5 accounting services that are tax deductible. Although it is a.

If you paid 6000 in fees to your advisor 2000 of that would have been eligible for the deduction. However please bear in mind that due. The Section 179 Tax Deduction allows for a maximum deduction of 500000 on new or used equipment provided it is put into service within the tax year.

Luckily for the small business owner many of these expenses can be claimed as a deduction on federal income taxes within limits of course. The HMRC allows companies to claim a tax deduction for some fees that your accountant charges. The Tax Cuts and Jobs Act however eliminated these deductions beginning.

Expenses are solely incurred in the production of income. As a Senior Tax and Accounting Services you will be responsible for preparation of year-end tax closing including journal entries. Expenses are not a contingent liability.

For example if the total house size is 2400 square feet and the home. Are accounting services tax deductible. The short answer to this is yes.

These progress billings will be shown in the final bill which will detail the total cost for those statements. Services and Time vs. To be considered a deductible expense all conditions below must be met.

Track Everything In One Place. Accounting Services Tax Deductible. How Credits and Deductions Work.

Are Vacations Tax Deductible When Combined With Business Travel Accounting Freedom

16 Amazing Tax Deductions For Independent Contractors Next

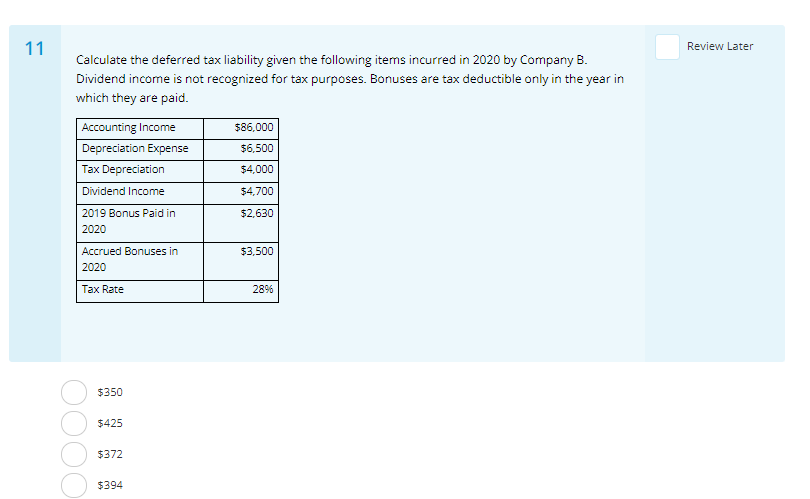

Solved 11 Review Later Calculate The Deferred Tax Liability Chegg Com

How To Deduct Medical Expenses On Your Taxes Smartasset

25 Small Business Tax Deduction You Should Know In 2022

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Tax Return Small Business Partnership Depressed Angle People Monochrome Png Pngwing

Small Business Expenses That Are Fully Tax Deductible

Tax Deductible Defintion Examples Personal Vs Business Related

Equity Tax And Accounting Services Dearborn Mi Facebook

Book Income Vs Tax Income Taxslayer Pro S Blog For Professional Tax Preparers

Are Legal Expenses Tax Deductible Steven M Vogt Cpa Ea

21 Small Business Tax Deductions You Need To Know Nerdwallet

Tax Deduction Recorder 175 Pkg Item 01 700

Meals Expenses Tax Deductibility 50 Vs 100 Wfy

The Ultimate Small Business Tax Deductions Checklist 1 800accountant

Expanded Meals And Entertainment Expense Rules Allow For Increased Deductions Our Insights Plante Moran